Advancing the Digitalisation of Global Trade in Türkiye, by Meral Sengoz

As global trade becomes increasingly digital, countries like Türkiye are embarking on ambitious initiatives to modernise and streamline their trade finance systems. The importance of this shift was highlighted at the EBRD Conference on the Digitalisation of International Trade in Morocco on June 25, 2024.

A key focus of the discussions was Turkey’s efforts to align its legal framework with global standards, particularly through the "Supporting Digital Trade in Türkiye Through Legal Reform Project" (MLETR Türkiye Project), aimed at harmonising the country's trade legislation with the Model Law on Electronic Transferable Records (MLETR).

Drawing from my banking and fintech experiences at Marco Polo Network and Contour, it's clear that while fintech companies are driving this transition, significant legal challenges remain. Their agility and technological innovation make them crucial players in the digital revolution. However, the absence of robust legal structures—both locally and internationally—hampers their ability to scale efficiently.

This blog will delve into these challenges and the opportunities ahead as Turkiye navigates its digital transformation journey.

This legal absence has created two major challenges:

The first challenge is related to the onboarding of new entrants. In the absence of national and international legislation governing digital commercial records, the only viable option for establishing a legal framework is to rely on private law. However, this requires the drafting of a large number of legal documents, which prolongs the onboarding process and requires the use of technology-savvy lawyers.

The second challenge relates to the transferability of electronic trading documents, particularly documents of title. For example, a company that is a member of a digital network cannot transfer a Bill of Lading or a Bill of Exchange to a bank that is not part of the same network. This is a major barrier to the smooth flow of possession of goods, the exchange of trade data and the ease of trade finance.

Paradoxically, in our quest to eliminate paper-based trade, fintech organisations end up signing more paper.

Therefore, the adoption of MLETR appears to be a critical building block for widespread and seamless trade records transactions across trade corridors.

The strategic role of digitalisation in Türkiye's trade and economic policy

As in many countries, digitalisation plays a strategic role in Türkiye's trade and economic policy, along with other key pillars. Such as trade facilitation, export financing, technology oriented free zones, market diversification and new exporters.

The main objective of Türkiye is to enable the harmonisation of local legislation with EU regulations on the digital economy. In this sense, the MLETR Turkiye project is well aligned with the country's digitalisation objectives.

The objective and the approach of MLETR Türkiye Project

The main objective is to assist the Ministry in developing a business case for amending the local legal framework to align with the MLTER (Model Law on Electronic Transferable Records).

This involves conducting desktop research, interviews and surveys with relevant local and international stakeholders to obtain appropriate data that can be used to determine the economic benefits of legal reform.

To achieve this objective, the T3i Partner Network brought together its expertise in trade, trade finance, digitalisation, technology, academic research skills and MLETR knowledge.

We conducted in-depth semi-structured qualitative interviews with banks, SMEs, corporates, custom service providers, leasing, factoring and insurance companies, as well as accelerators such as the ICC Banking Group and trade associations.

Then we used two different surveys for banks (including finance) and companies to get reliable research results. The number of banks surveyed is 50 and the number of companies surveyed is 181.

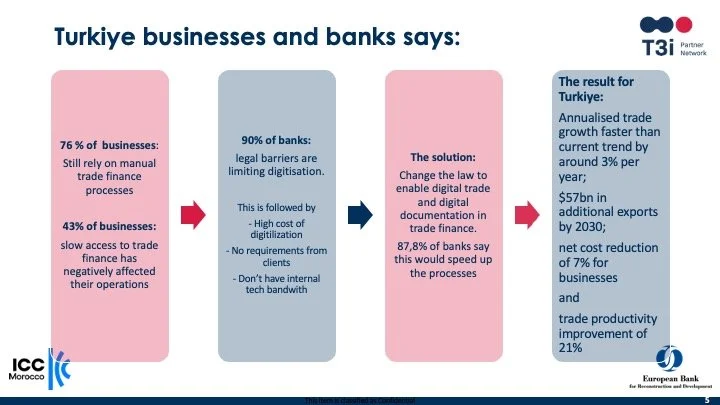

Türkiye businesses and banks says:

Even though there have been lots of digitalisation studies in Turkiye, our MLTER research showed that

76% of businesses in Turkiye still rely on manual processes for their trade finance.

43% of them say slow access to finance has been negatively affecting their growth and operations.

Additionally, 90% of banks are saying that legal barriers are holding them back from going digital.

Of course, there are other challenges to digitisation, like high costs of investment, unmature internal tech bandwidth and insufficient requirements from clients. But it seems that the legal framework is the main obstacle for digitalisation of trade and trade finance.

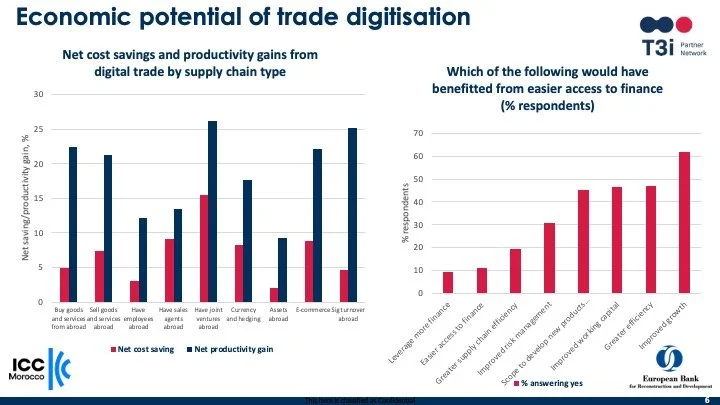

Economic potential of trade digitization

In the research, we’ve identified net cost savings and productivity gains from digital trade by supply chain type;

Firstly, companies operating with joint ventures overseas, along with firms experiencing significant international turnover, are poised to reap substantial benefits.

Additionally, businesses active in e-commerce field find digital trade particularly advantageous.

Lastly, both exporters and importers see marked improvements in operational efficiency and cost management through digitalization of trade and finance.

When we asked businesses about the benefits of easier access to finance, the results were striking. As shown in the graph, over 60% indicated that easier finance would drive growth in their business. Nearly half highlighted benefits such as greater efficiency, improved working capital, opportunities for developing new products and technologies, and better risk management.

It seems that digital trade finance is a critical catalyst for international trade and a potential game-changer for business efficiency and innovation.

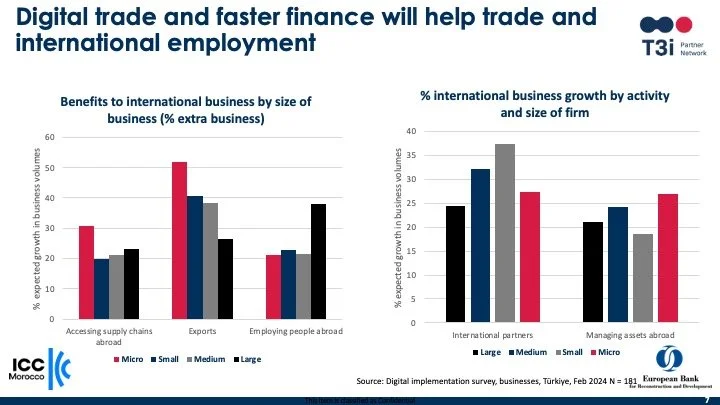

Digital trade and faster finance will help trade and international employment

The charts compare the expected growth in business volume of some business areas.

It shows that digital trade and faster finance will mainly help SMEs especially in the sense of Exports. Apparently, “micro” enterprises expect huge impact on their export activities.

Note that 99.s8% of enterprises are SME in Turkiye with 91% of them in the Micro segment, while 8% aresmall enterprises . This means that digitalisation could help a lot to especially for micro and small ones.

The large companies are expecting to hire employees abroad, build international partnerships and own assets abroad as a result from digitalisation. This shows business industry need more international collobration in the sense of partn This highlights the growing need for greater international collaboration across industries, particularly in terms of partnerships, resource management, and asset development, so businesses will be prepared to manage more volume while increasing its need for digital tools to streamline trade and trade finance operations.

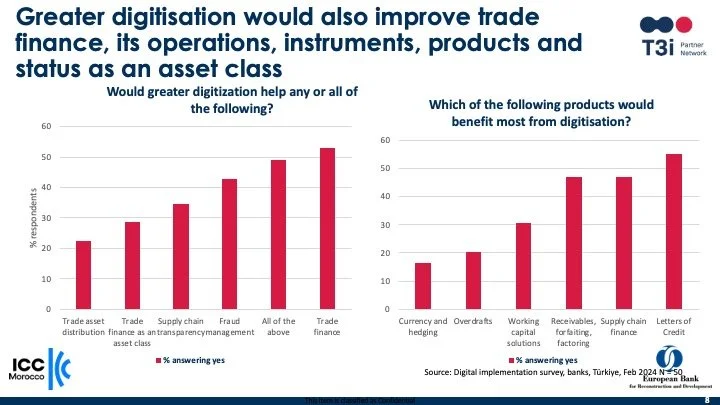

Greater digitisation would also improve trade finance, its operations, instruments, products and status as an asset class

As it can be seen from the left graph, greater digitisation would help substantially to trade finance, fraud management, supply chain transparency.

This is in line with our interviews: firms say more digitalisation would make their trade finance simpler and reduce fraud incidents, besides it would make their supply chain more transparent which is crucial for trust and efficiency.

Additionally, there is clear evidence that the technical and most complex aspects of trade finance would benefit from digitization

Letter of Credits (55%)

Supply chain finance (46%)

Receivables, forfaiting and factoring (46%)

These are also the areas which take a lot of time.

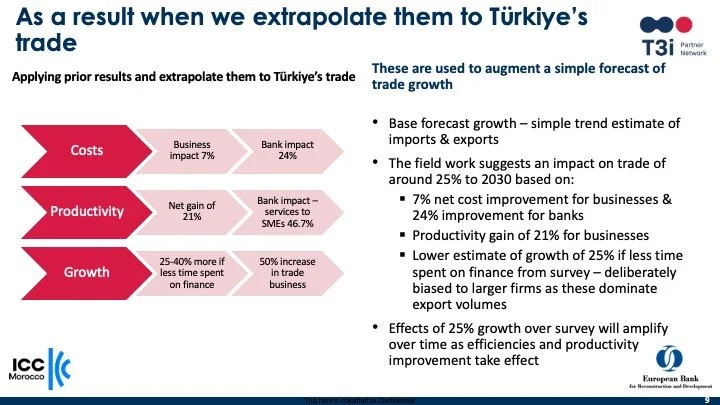

As a result when we extrapolate them to Türkiye’s trade

So if we extrapolate all the results:

We can expect 7% net cost improvement for businesses & 24% improvement for banks

We can enable 21% productivity gains for businesses through digital commerce

And we see a growth opportunity of at least 25% in business and finance.

Conclusion and Digital Trade Road Map – Focus points for Türkiye

As a result, it seems that alignment with MLETR is the foundation of the trade and finance digitisation journey.

Other building blocks are digital trade rules and standards, adherence to UN and EU digital norms, international agreements on digitisation, digital identities, simplification of processes, collaboration of fintechs, logistics providers, etc.

As Yuval Noah Harari mentioned in his book "Sapiens: A Brief History of Humankind", humanity dominates the Earth because of our ability to work flexibly and effectively with large numbers of people.

Despite many challenges, the trade and trade finance industry is seeking a new digital age through cooperation, competition and the exploration of new technologies.